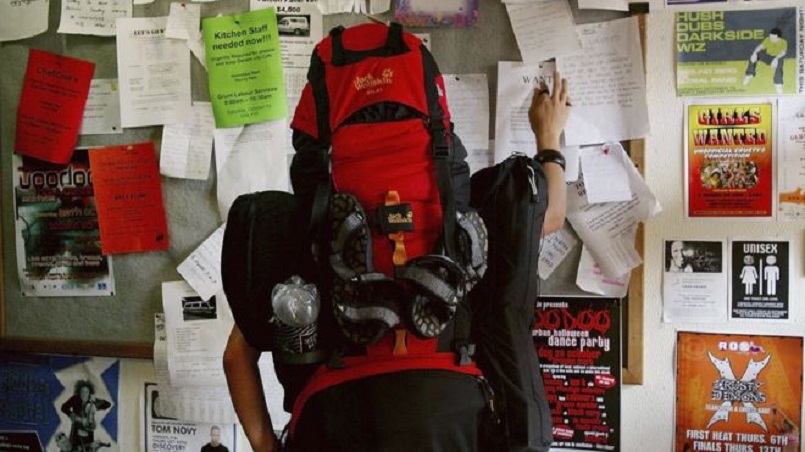

The Australian government has scrapped a plan to impose a 32.5% tax on backpacker workers.

Working holidaymakers will instead be liable for 19% tax on every dollar that they earn.

The compromise deal follows an outcry from farmers and the tourist industry.

Farmers complained the tax rate could affect their labour supply at harvest time, while tourism operators maintained it would put backpackers and tourists off visiting Australia.

About 600,000 backpackers travel to Australia every year and many of them find work picking fruit.

"We recognise absolutely the important part that backpackers play in the overall tourism industry," Treasurer Scott Morrison told reporters in Canberra.

"It is an important sector for the tourism industry, also a very important source of labour in the agricultural sector, particularly for seasonal labour," he added.

Other changes?

Mr Morrison said the cost of working holiday visa applications would also be cut by 50 Australian dollars (£29.50; £38) to A$390.

At present, backpackers, like other workers, do not pay any tax until their income exceeds A$18,200 a year.

The government had expected to collect A$500m from the backpacker tax, which was first proposed in the government's 2015 budget.

To offset the lower tax rate, the tax on passengers departing Australia will be increased by A$5.

The tax changes are set to come into force on 1 January 2017.